Collingwood Insurance Jargon Buster

Learning to drive and getting insurance can be a confusing time with so many new words and terms thrown at you at every turn. We have put together this helpful jargon buster to help you understand key terms relating to your policy.

Collingwood customers can earn an accelerated No Claims bonus with only 10 months of continuous cover.* A No Claims Bonus may offer a discount on your next insurance as it proves that there have been no accidents or incidents for the policyholder. We cannot guarantee that your next insurer will accept the No Claims but it will be sent to you if you meet the criteria.

Terms, conditions and underwriting criteria apply.*

Accidental or malicious damage is a type of cover that helps pay for damage to your vehicle, whether it happens by accident or because someone damages it on purpose. Accidental damage might include things like bumping into a post or scraping another car. Malicious damage covers things like vandalism, such as someone keying your vehicle or smashing a window. It’s useful because even small damage can be expensive to fix and might stop you from using your vehicle.

This is the person that will sit with you when you are learning to drive. They must be a full licence holder, who is aged 21 or over and has held a full licence of the required type (manual or automatic) for at least 3 years. The accompanying driver must sit in the front passenger seat of the vehicle to ensure that it is being driven in a safe and legal manner. They must be in the car at all times while you are driving.

An additional driver is a person that is added on to an insurance policy who can then legally drive a car and is protected under the policy holders insurance.

An ADI is an Approved Driving Instructor. This means that the person has fully completed all 3 tests to qualify as a professional instructor and is now on the ADI register. They are able to teach people to learn how to drive and offer professional driving lessons.

Annual cover is a type of insurance policy which covers the policyholder for the full year.

This is a camera used by the police to check licence plates on cars. When driving past these cameras your car registration is checked against the police database.

“We use ANPR (Automatic Number Plate Recognition) technology to help detect, deter and disrupt criminal activity at a local, force, regional and national level. This includes travelling criminals (those using the road network to avoid being caught), organised crime groups and terrorists.” –Police.uk

If you are in an accident and your car needs repairs we will suggest an approved repairer. This is a vehicle repairer authorised by Collingwood or our representative to repair the insured vehicle following a valid claim of the insurance.

This is the audio equipment that comes installed in a car to let you listen to music, the radio, or other sounds while you drive. It includes things like speakers, the stereo or head unit, and sometimes a built-in screen or Bluetooth connection. Some cars come with very basic systems, while others include more advanced features like touchscreen controls or voice commands. Whether factory-installed or added later, audio equipment is part of the vehicle’s entertainment setup and is usually used for personal enjoyment while driving. It should always be used in a way that doesn’t distract you from the road.

This means that the cost to repair the vehicle is more than the cost of a replacement or the market value of the vehicle.

Telematics is often referred to as Black Box Insurance. This is a type of insurance where you car has a box that tracks your driving to ensure safe driving.

Breakdown cover assists you if your vehicle breaks down. For example your battery dies or your tyres puncture, breakdown cover can assist so you are not left stranded. Depending on the level of breakdown cover you may be able to have the car towed, roadside repairs and more.

This is a type of insurance class whish means that the car is used for your job. Such as driving to multiple sites of work or using the car for sales or deliveries.

Car use for business use may need a specified policy such as hire and reward. Business use on a car that is not insured to do so may go against the terms and conditions of a policy and effect the insurance if there is a claim.

Most new cars are assigned an insurance group. This is a rating between 1 and 50*. It is used to indicate the level of risk for insurers. The lower the group number the lower the insurance premium should be. This means that the insurance group can give you an idea of insurance costs when comparing different models.

You car registration sometimes known as number plate or car reg, is the identifier for your car. This is the plate on the front and rear of your vehicle and allows the DLVA to recognise your vehicle.

The Certificate of Motor Insurance is evidence that your vehicle is insured. This is required b the Road Traffic Act to ensure a vehicle has at least the minimum level of insurance on the vehicle (Third party only). This will be issued out by your insurer after you have taken out an insurance policy.

In the event of an accident or incident you should report this to your insurance company. This will create a claim and the insurance company will work with you to come to an outcome. This will aim to resolve costs and damage to the vehicle depending on the circumstances.

This is an insurance class that means that the car will be used to go to and from a place of work.

Comprehensive cover, is the highest level of insurance for your car. It allows you to claim from your insurer for accidents that are deemed to be your fault, or when the fault of an accident can’t be proved. For example if you return to your car to find it has been damaged and the offender has driven off.

You may want to cancel an insurance policy if you have just bought it and have changed your mind. By law, you have a minimum 14-day cooling-off period during which you can cancel the policy for any reason.

A courtesy car is a vehicle provided by a garage or repair shop for use while your car is being repaired. A courtesy car may be provided as standard on your car insurance policy, or you may need to purchase it as an optional extra. With Collingwood, this is only available on the comprehensive cover and subject to availability.

The Driving Instructors Association is the UK’s largest professional body for driver, rider training and education. The DIA offers support, professional development and training to trainers working across all vehicle and licence categories.

A Driving Instructor is a person who teaches you how to drive. They are qualified to teach driving and can help you learn and improve your driving skills.

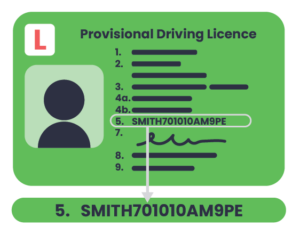

Your driving licence number is a 16-character code on your photocard. It’s a mixture of letters and numbers found on your licence underneath the licence’s expiry date. This will need to be validated for your insurance policy to show you have entitlement to drive.

A driving licence photocard or provisional licence is used as proof that you are able to learn to drive. The card is issued out by the DVLA. The card contains your photo, signature and information about your eligibility to learn to drive. You must have this before you start learning how to drive.

Driving tuition is when you work with a driving instructor for driving lessons. During the lessons you will learn key skills to help you pass your driving test and obtain your full driver’s licence.

The Driver and Vehicle Licensing Agency (DVLA) holds the database of driver records in the UK. Along with registration and licencing of vehicles, in order to keep vehicles taxed on on the road.

The DVLA check code is the online counterpart of the photo card driving licence. If you are waiting for your licence this may be required to check your eligibility for insurance, It is used to access the DVLA database to check driving licence information to view things such as penalty points and the type of vehicles you can drive. Find out how to get a check code on the DVLA website.

The Driver and Vehicle Standards Agency (DVSA), carry out driving tests, approve people to be driving instructors and MOT testers, carry out tests to make sure lorries and buses are safe to drive, carry out roadside checks on drivers and vehicles and monitor vehicle recalls.

Insurance excess is the defined amount you agree to pay towards any claim you make. There are often two types of insurance excess, compulsory and voluntary. Compulsory excess is the value you must pay and is set by the insurer. Voluntary excess is the amount that you are willing to pay in addition to the compulsory excess.

A Fault Claim is an accident or loss where you are considered to be to blame (at fault). It may also be an accident where your insurance company cannot recover their costs in full from someone else.

The FCA is an independent UK non-governmental conduct regulator for financial services firms and financial markets. The FCA operate to ensure consumers get a fair deal. Collingwood are authorised and regulated by the FCA.

Sometimes referred to as ‘fully comp’ is the highest level of insurance for your car. Comprehensive car insurance allows you to claim from your insurer for accidents that are deemed to be your fault, or when the fault of an accident can’t be proved e.g. if you return to your car to find it has been damaged and the offender has driven off.

An insurance policy is a contract that defines the obligations of both the insured and the insurer.

An insurance policy number is a unique number assigned to an insurance policy once you have purchased insurance. This may be needed if you are calling up or enquiring about your policy.

The insurance premium is the amount that the insurance costs. This must be paid for a contract of insurance.

An Insurance Underwriter is a professional who evaluates the risks when insuring and establishes insurance prices based on this.

Insurance intermediaries facilitate the purchase of insurance. This means they handle insurance policies on behalf of the insurer. They also provide services to insurance companies and consumers during the insurance process. They are also sometimes known as insurance agents or insurance brokers.

An IPID is an Insurance Product Information Document. It provides information on Insurance products for potential customers to help make an informed decision on if the insurance is right for them. It is important to read through insurance documentation before taking out a policy.

Insurance Premium Tax is a government-introduced tax on insurance policies including car, home, travel and pet which every insurance provider has to charge.

Key cover protects the keys of your vehicle. In the event of theft or loss of the keys, key card or remote control transmitter of a vehicle. If you have this as part of your policy, it can help with lock replacement, replacement keys/key cards or replacement of engine control unit, alarm and/or immobiliser.

Learner Driver Insurance allows provisional licence holders to practice driving with a supervising driver. It is available on your own, friend or a family member’s car with Collingwood. Designed to sit alongside the car owners existing policy. Depending on the policy, it should cover the learner driver when they are behind the wheel and for their driving test.

Your log book or V5, is proof that you are the registered keeper of a vehicle. This means that you’re responsible for registering and taxing the vehicle. It contains all the information about your car, such as the name and address of the registered keeper, date first registered, number of previous registered keepers, the car’s Make and Model, colour and engine size.

The cost of replacing the insured vehicle with a vehicle of similar make, model, age and condition (including similar mileage).

The Motor Insurance Database is the central record of all insured vehicles in the UK. It is managed by The Motor Insurance Bureau (MIB) and is used by the Police and the Driver and Vehicle Licensing Agency (DVLA) to enforce motor insurance laws.

This is when you make changes to your insurance policy before the end of the policy. It is important to keep all of your insurance details up to date. Adjustments to your policy details may come with additional costs and changes to insurance premiums.

A car modification is a change made to a vehicle that differs from the manufacturers original factory specification. Examples of modifications are tinted windows, suspension changes, adding spoilers or changing exhaust. Modifications to your car may impact your insurance so you should discuss with your insurer before making any changes.

MOT is a test that all UK road vehicles more than three years old have to pass each year in order to prove that they are safe to drive. This is done by a garage to ensure the car is safe to drive and there are not any issues that need attention.

Named driver insurance is also known as additional driver insurance. This can allow somebody else to be covered with your insurance policy.

When you pass your driving test you will no longer be a learner driver and you will now be a new driver. As a new driver you will need to take out a new insurance policy which is often more expensive. This is because there is a higher risk of accidents now that you will be out on the road alone. At Collingwood we may be able to help you find insurance as a new licence holder with one of our affiliates.

A No Claims bonus (NCB), is a count of the number of years in which you haven’t made a claim on your car insurance policy. It can sometimes offer discount on insurance policies.

This is a type of claim where you are not seen to be at fault and another driver accepts the blame. This means that the accident or incident was not your fault. This means that the insurer can recover full cost.

Pass Plus is a practical training course (once you have passed your driving test) that takes at least 6 hours. It is for drivers to improve their skills and drive more safely. Pass Plus may help you get a car insurance discount if you successfully complete the course.

PDI stands for Potential Driving Instructor. This is a trainee driving instructor. They are currently still in training, working towards becoming an ADI.

If you commit a motoring offence you may get points on your licence. If you get 12 or more points this will result in a driving ban. You can get penalty points on a provisional licence. Depending on the type of offence and how many points this could impact your ability to take out insurance.

Personal Accident cover is an add-on for you insurance policy. It covers you and your passengers in the event of loss, damage, death or bodily injury caused by a road traffic accident whilst driving.

Policy documents will be provided by your insurance provider. This will outline, terms and conditions, proof of cover and other important documents. If you are insured with Collingwood you will be able to download these at any time by logging into your account.

A policyholder is a person or group in whose name an insurance policy is held. This will identify who is insured on the insurance policy.

A practical driving test is taken with the DVSA to see if you are able to become a full licence holder. During this test you will be assessed on your driving knowledge and safety. If you pass you will become a full licence holder and be able to drive independently.

Your learner driver policy will be invalid as soon as you pass your practical driving test. Be sure to cancel your policy and do not drive the vehicle until you are insured as a full licence holder.

Private practice is getting more driving experience with a supervising driver. In order to get private practice the learner driver must have their own insurance policy or be added as an additional driver on the car owners insurance.

A Protected No-Claims Bonus allows you to have a certain amount of “at fault” accidents without affecting the bonus. So if you have an accident, the NCB remains intact even if the insurer can’t claim any costs back.

Provisional cover is also known as learner driver insurance. In is a type of insurance policy that allows provisional licence holders to get private practice with a supervising driver.

A provisional driving licence is an official document that gives you permission to drive on the UK roads, whilst under the supervision of your driving instructor or a supervising driver. Who is over the age of 21 and has held a valid driving licence for 3 or more years. In order to drive you must be insured or working with a driving instructor who is insured to teach a learner driver.

The registered keeper is the person responsible for taxing the vehicle, insuring it and ensuring it has an MOT and any services.

Remaining cover is how long is left on your insurance policy. Once the insurance policy has ended you will no longer be covered by your insurance.

Short term insurance varies depending on the insurer. Here at Collingwood, our short-term policies start from 2 days with the ability to top up 7 days. You can cover yourself to drive your own car or someone else’s.

This is a class of use for insurance. This means that you will be using the car for day to day driving. Social, domestic and pleasure means driving to meet friends, daily task, outings and holidays. It does not cover commuting or business use.

A Statutory Off Road Notification (SORN) must be made when you take a vehicle ‘off the road’ and you wish to stop both taxing and insuring your vehicle. Head to the government website to find out more about when you need to make a SORN.

The form that shows the information that you gave us or was given on your behalf. We have relied on the information provided on this form in entering into this contract of insurance. If there are any alterations to the facts shown in this form you should inform Collingwood as soon as reasonably possible.

A full licence holder who is aged 21 or over and has held a full licence of the required type (manual or automatic) for at least 3 years. The accompanying driver must sit in the front passenger seat of the vehicle to ensure that it is being driven in a safe and legal manner.

Telematics is often referred to as Black Box Insurance. This is a type of insurance where you car has a box that tracks your driving to ensure safe driving.

Third Party Insurance (TPO) is the minimum amount of cover you can get. It only covers damages for other vehicles, properties and people in an event of an accident that was deemed to be your fault. Your passengers will also be covered.

Third party fire and theft insurance (TPF&T) covers you for any damage caused to a third party or their property if you are involved in an incident. It also covers your own car if it’s damaged by fire or stolen.

If there has been an accident of incident your car could be a total loss or write-off. This means it either cannot be repaired or would cost more to repair than to replace.

Underwriting criteria is a set of standards and guidelines that determine risk exposure and help establish an insurance premium that needs to be charged to insure a person and a vehicle.

Your log book or V5, is proof that you are the registered keeper of a vehicle. This means that you’re responsible for registering and taxing the vehicle. It contains all the information about your car, such as the name and address of the registered keeper, date first registered, number of previous registered keepers, the car’s Make and Model, colour and engine size.

Insurance excess is the defined amount you agree to pay towards any claim you make. Voluntary excess is the amount that you are willing to pay in addition to the compulsory excess. You can decide how much voluntary excess you wish to pay when you are taking out your policy.

Windscreen Cover helps pay for fixing or replacing your car’s windscreen or other windows if they get damaged. Chips, cracks, or even shattered glass can happen from things like stones hitting the windscreen while you drive. Windscreen cover helps make sure the cost of repairs or replacement isn’t too high. It can also include side and rear windows, and sometimes glass sunroofs. This type of cover is useful because driving with a damaged windscreen can be unsafe and even lead to legal issues.