Dual Carriageways and Single Lanes: What You Need to Know

Learn the difference between dual carriageways and single lanes, including speed limits, rules, and guidance, and whether learner drivers are allowed.

We’re currently experiencing intermittent system issues. We apologise and are working to resolve them as quickly as possible.

If you’re a learner driver, provisional insurance will help you get that all important extra practice. Provisional insurance allows you to undertake private practice in a friend or family members car. Before you purchase learner driver insurance it’s important to understand a few rules.

In this article we’ll be looking at learner driver insurance rules and what UK provisional licence holders need to be aware of when undertaking private practice.

Before you buy alearner driver insurance policy, you will need to ensure you are legally allowed to take to the roads. We recently discussed this in our provisional licence guide, but the law requires the learner driver to:

-Be at least 17 years old

-Have a valid UK provisional driving licence (for the type of vehicle being used – manual or automatic)

-Ensure the vehicle is in a safe and legal condition

-Meet the legal minimum eyesight standards

-Have a supervising driver who is at least 21 years old and has a valid driving licence, which they have held for at least three years. This must be for the same transmission type of the vehicle automatic/manual.

–Put L Plates (or D Plates in Wales) on the front and rear of their vehicle.

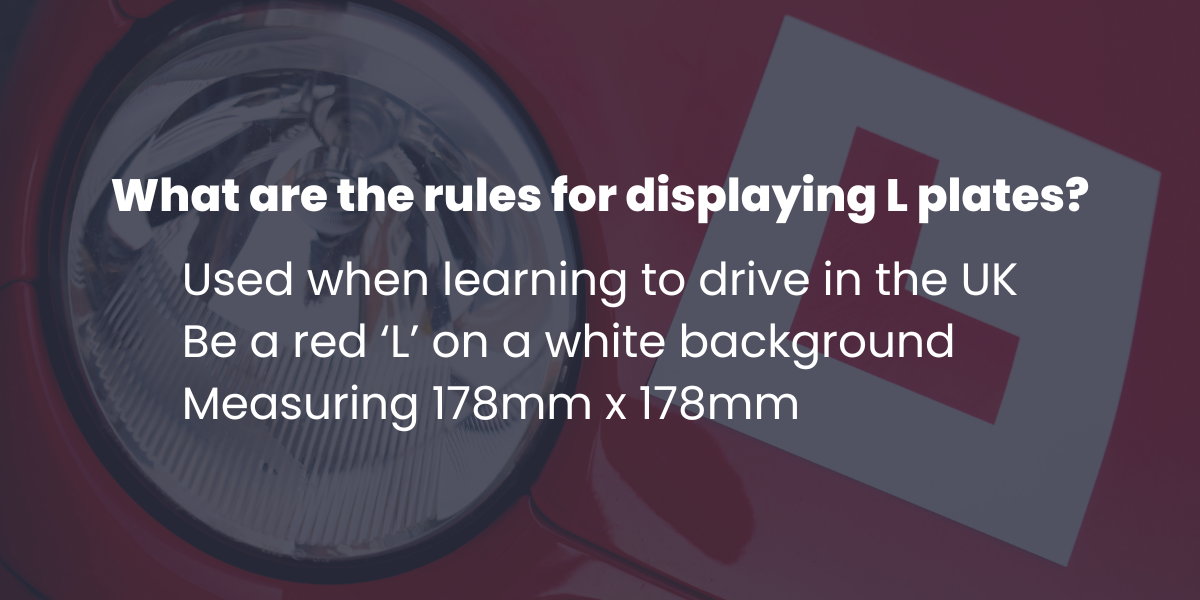

It’s important to be aware of the rules regarding the use of L plates. If you use the wrong type of plate, you could get up to 6 penalty points, which is definitely not the best way to start your driving life. L Plates must:

-Always be displayed of the front and back of the vehicle when a learner is driving

-Be a red ‘L’ on a white background

-Should measure 178mm x 178mm

-In Wales, a ‘D’ plate must be a red D on a white background also measuring 178mm x 178mm.

Learner driver insurance policies can offer:

Options for the 3 major types of motor vehicle insurance cover (third party only, third party fire and theft, comprehensive)

An option to add an additional driver

Optional add-ons including windscreen cover, courtesy car and audio equipment cover

Can run parallel to full insurance on somebody else’s car

Learner driver insurance, like full insurance will show in ‘AskMID’ (the motor insurance database) so you should never be tempted to try an uninsured 1 hour practice session.

Sign up today for exclusive offers, practical guidance, driving tips, and more!

If you are interested in provisional insurance cover, then look no further. Collingwood offers learner driver insurance that can cover you from 2 days to 12 months. If you’re insured on your own vehicle you could also start to build your own No Claims Bonus before you have a full UK driving licence.

*Dependent on the level of cover chosen and add-ons selected. T&C’s apply.

You will be logged out in seconds. Do you want to stay signed in?